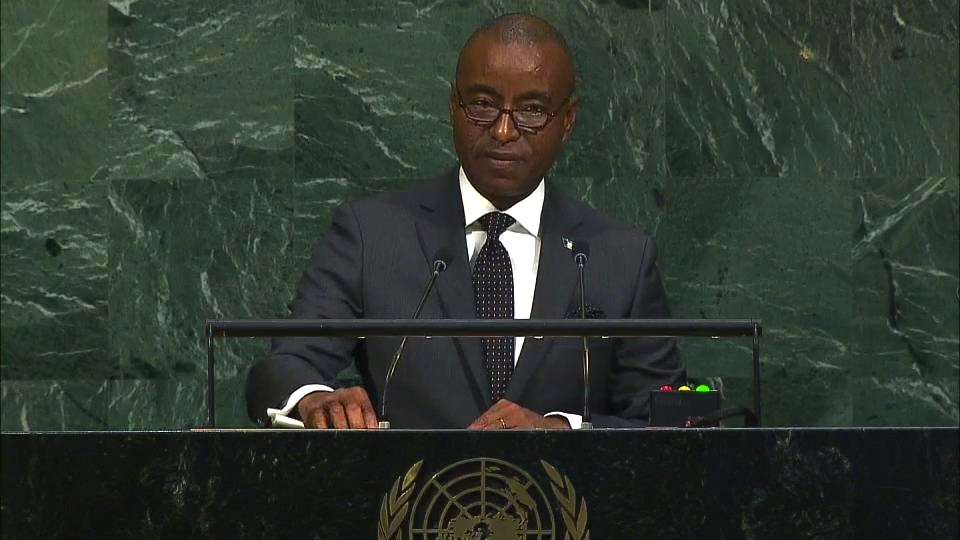

Notwithstanding The Bahamas’ best efforts at self-sufficiency, exogenous shocks, in the form of reduced correspondent banking relationships, continue to create challenges for the region, according to Minister of Foreign Affairs Darren Henfield.

Henfield’s comment came as he expressed the country’s fear of banking relationships during his address at the 72nd United Nations General Assembly in New York on Saturday.

He complained that international banking institutions, fearing that they may be subject to fines and sanctions related to illicit activities of money laundering and terrorist financing, have pulled out “en masse.”

“Citizens in our region depend of the services provided by these entities, and have now become severely disadvantaged as a result of the actions taken,” Henfield added.

“This threatens our ability to remain competitive as one of the leading international centres and hinders our efforts to expand our trading relationships.

“The Head of the IMF, Ms. Christine Lagarde, spoke convincingly in 2016 on the subject of correspondent banking, highlighting that all stakeholders had to uphold their end of the bargain.”

He explained that The Bahamas has invested in a strong compliance regime, at great financial costs.

“We invite the international community to work together to find another way to deal with the issue and allow input from those to be impacted by their decisions before moving the goalposts again,” Henfield said.

“Despite the challenges faced, the government of The Bahamas remains committed to a comprehensive development agenda for the country. With the launch of the National Development Plan Vision 2040 in the coming months, we will set a course towards the achievement of the SDGs.

“In this connection, The Bahamas has committed to participating in the Voluntary National Review process at the High-Level Political Forum on Sustainable Development under the auspices of the Economic and Social Council in 2018.”