By: Keile Campbell

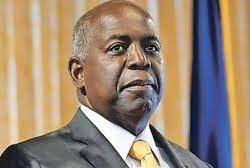

Prime Minister Philip Davis gave remarks at the financial tech conference event D3

Bahamas, and expanded on the nation’s involvement in fintech as well as what to expect for

its future in the sector.

The prime minister spoke of The Bahamas’ pioneering and innovation in digital assets,

particularly the passing of the Digital Assets and Registered Exchanges (DARE) Act, 2020

while further expanding upon his administration’s work to amend the legislation which he

says is expected to be table and passed in Parliament by the end of the year.

“Since the initial introduction of the DARE Act, the cryptocurrency world has gone through a

number of changes, and in the spring of last year, we began responding to those changes with

a slate of amendments that will reinforce our standing among the best-regulated jurisdictions

in the world.” The prime minister explained.

“We are a responsive and nimble financial services jurisdiction and, as promised when

DARE was implemented, we remain committed to consistently updating and evolving our

regime to meet the latest threats and risks as they emerge.”

“The changes to the DARE Act will include – among other things – measures to clarify the

regulation of stablecoins, and the introduction of more robust investor and consumer

protection mechanisms, including new provisions for a single framework for the registration

and oversight of digital assets custodians and the provision of custodial wallet services and

requirements for the segregation of assets. We are also introducing a disclosure framework

for the staking of clients’ digital assets and the operation or management of a staking pool as

a business.”

At the same D3 Bahamas event, Securities Commissioner of the Bahamas Executive Director

Christina Rolle stated that the FTX collapse contributed to the regulatory landscape of global

cryptocurrency, a sentiment Prime Minister Davis shares.

The prime minister was defiant against “nay-sayers”, firmly stating that The Bahamas will

continue to pioneer in the digital assets industry not only in response to the experience of the

past three years, but in anticipation of future opportunities.

“The Securities Commission of The Bahamas is deeply involved in the work of the IOSCO

FinTech taskforce, and made significant contributions to its reports on Crypto-assets and

Decentralized Finance, released in May and September, respectively. Through the

Commission’s work with IOSCO and ongoing engagement with other regulators globally,

The Bahamas will remain a leader in the regulation of crypto-assets.” Prime Minister Davis

continued.

“Web3 and Fintech will transform global financial systems in unprecedented ways, and the

Bahamian people are positioned to be at the vanguard of this rapidly expanding frontier.”

Acknowledging the financial services industry as the country second largest industry after

tourism, Prime Minister Davis recognized the potential fintech has in contributing to

domestic growth and development locally.

He mentioned the struggle of some Bahamians having to travel to the capital in order to do

their banking due to branches of financial institutions closing on the Family Islands,

underlining the importance of financial and digital inclusion.

Prime Minister Davis explained that “Despite the widespread use of the internet and

technology in day-to-day life, there are still many people in our societies who lack access and

knowledge. They are now in danger of being left behind. This digital divide, in many ways,

reflects pre-existing income and social challenges. Those who would benefit most from

inclusion in digital and financial systems are often the ones who have the least access.”

“Web3, DeFi, and Fintech, in general, represent such great opportunities for growth – it

would be a shame for the world to move forward without using these technologies to address

inequity and injustice. We cannot allow this new economic reality to mature while preserving

inequality. Investments must be made to close the digital divide for all people, as we expand

financial inclusion efforts through emerging technologies. After all, isn’t the point of these

advances for us to make a better world tomorrow than the world as we know it today?” He

said.

Prime Minister Davis spoke of his administration’s focus on providing educational

opportunities for the development of a domestic fintech industry, mentioning The University

of The Bahamas’ (UB) licensing agreement with the Cambridge Centre for Alternative

Finance for exclusive rights to its FinTech and Innovation academic program for qualifying

full-time and continuing education students.

A partnership between UB, the Securities Commission of The Bahamas and the University of

Cambridge, he says, will include Bahamas-specific case studies and Bahamas-specific

references, professing education to be key to The Bahamas becoming a hub for fintech.